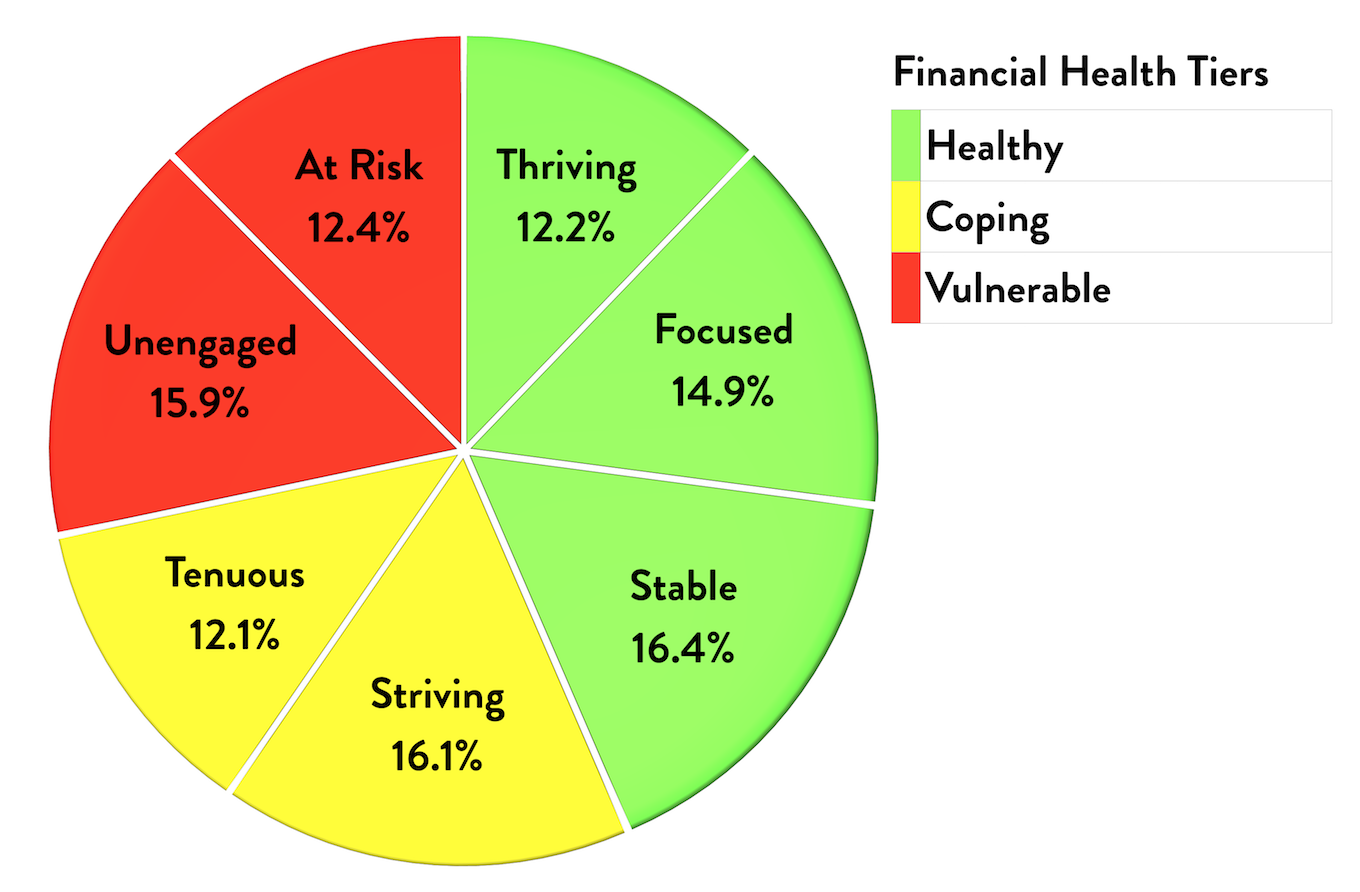

According to CFSI’s Consumer Financial Health Study, nearly half of American households struggle to keep up with their bills and credit card payments. Most U.S. households are concerned about their financial health and aren’t confident they can meet their long-term goals for financial security.

The landmark study surveyed more than 2,000 American adults and their responses were weighted to ensure the study was representative of the U.S. population. CFSI’s analysis of consumer behaviors, attitudes, and preferences revealed the following 3 financial health tiers and 7 financial health segments:

As you might expect, household income is a significant factor in predicting a household’s financial health. Surprisingly though, households earning $100,000 or more are only 1.4 times more likely to be in one of the 3 Healthy financial segments than households earning less than $30,000 per year. Sixteen other variables rank higher than income in determining a household’s financial health.

Which variables rank highest in determining a household’s financial health segment?

Holding all other variables constant (including income, age, and other demographic characteristics), indicators related to planning ahead and saving proved to be the most successful variables in predicting a household’s financial health segment.

The majority of those with annual household incomes under $30,000 who are also in the study’s thriving segment responded that they plan ahead for large, irregular expenses and save with a plan.

In fact, households that plan ahead for large, irregular expenses are 10 times more likely to be in one of the Healthy segments.

The entire report is excellent and has a lot of encouraging findings for a personal finance writer like me. The study’s findings suggest resources like this website that encourage people to adopt beneficial financial habits can, in fact, play a positive role in helping households achieve financial health.

Improving Your Financial Health

For me, being financially healthy means understanding your historical income and spending, establishing clear financial goals, and ensuring your current behaviors support your financial plans. Becoming more mindful of the relationship between your financial past, present, and future can give you more control over your financial destiny.

For me, being financially healthy means understanding your historical income and spending, establishing clear financial goals, and ensuring your current behaviors support your financial plans. Becoming more mindful of the relationship between your financial past, present, and future can give you more control over your financial destiny.

Here are 6 steps you can take to improve your financial health:

1. Categorize your Income and Expenses

A common response to a feeling of financial helplessness is sitting down to create a budget. While budgets can be empowering, jumping right into budgeting without a firm grasp of your current income and expenses is a meaningless exercise. Any budget is likely to fail if it isn’t adequately grounded in the reality of your financial means and obligations.

Before establishing a budget, you should first track your income and expenses and group all of your transactions into as few or as many categories as you find useful.

How much history do you need?

Ideally, you’ll have at least a year’s worth of your earnings and spending categorized and available for your review. Having 12 months of history is great because it’s sure to include any periodic income or expenses that only occur once per year, once per six months, or once per quarter.

If you don’t have 12 months of history to begin with though, you can get started with as little as one month of data. And if tracking your earnings and spending sounds difficult, it really doesn’t need to be. If you have a checking account, you can easily track your income and expenses.

So how do you go about tracking your financial transactions?

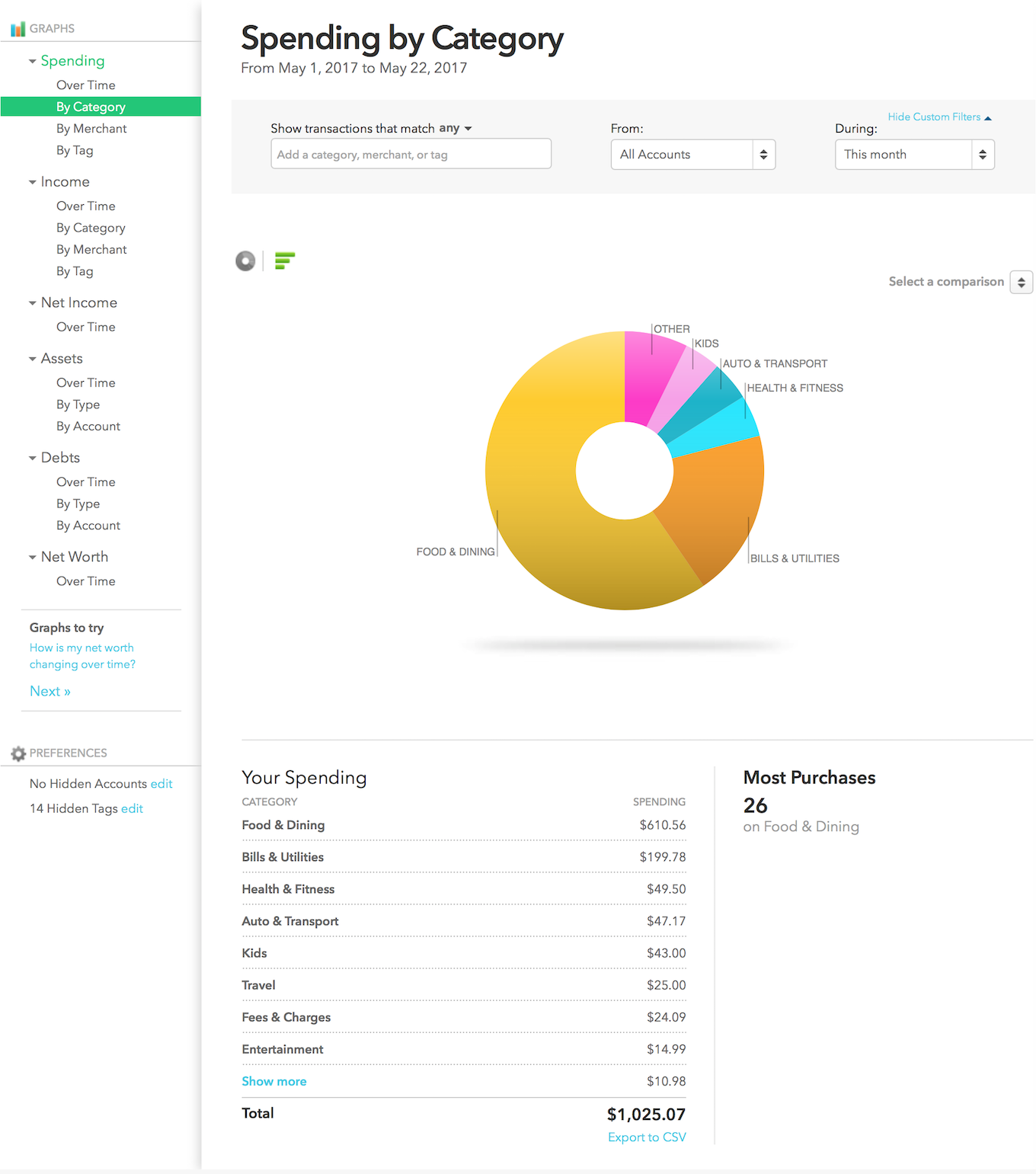

Your bank statement includes a chronological list of transactions in your account, but it doesn’t offer any analysis. It’s a limited tool for understanding your spending. To see how much you spend on groceries, fuel, or other categories, you would have to manually add up each transaction in a given category. That isn’t a sustainable practice or good use of your time.

Thankfully, there are several free tools available that can automatically categorize your income and spending for you. Ellen and I have been using Mint.com for this purpose since 2008 (before that we used Quicken and later iBank). Mint categorizes our transactions for us with near-perfect accuracy. When there’s an error, we can easily update the transaction with the correct category. We’re also able to add all of our accounts and see the sum of our spending.

2. Calculate Your Net Worth

Your net worth is simply the difference between your assets (everything you own) and liabilities (everything you owe). It’s important because it tells you where you are currently at financially. It will change over time as you earn and spend money, pay down any outstanding debt, and as the value of your assets change over time. As you invest your money, it’s typical for your net worth to rise and fall over time due to changing market conditions and your account activity. Knowing your net worth is important, but the real power comes in when you track your net worth periodically over longer periods of time.

While Mint.com will automatically track changes to your Net Worth over time, we rely on Personal Capital for this purpose. Personal Capital is another free online tool that can monitor all of your financial accounts, but it excels at tracking the performance of your investments and your net worth. Personal Capital provides insight into the fees of your investment accounts, your asset allocation, and a comparison of your portfolio’s performance to the broader market.

3. Establish Financial Goals

According to CFSI’s Consumer Financial Health Study, households that have a planned saving habit are 4 times more likely to be in one of the Healthy segments. Saving with a plan plays an important role in improving your financial health.

Without a plan, most individuals tend to spend more money as they progress through their careers and have more money to spend. This phenomenon is known as lifestyle inflation and it can have a devastating effect on your long-term ability to save toward big financial goals like buying a home, retirement, or simply building wealth.

While it’s helpful to include both short-term and long-term savings goals in your planning, I believe everyone should be saving toward a retirement goal regardless of age. And the sooner you start saving toward retirement, the better prepared you’ll be.

One of the most valuable lessons I learned in my early life was the Rule of 72. Einstein enthusiastically referred to it as the “eighth wonder of the world”. Essentially, dividing the number 72 by your expected rate of return will tell you the number of years it will take for your investment to double in value.

Using simple numbers, let’s say you invest $10,000 in the stock market at age 18 and expect a 7.2% return. 72 divided by 7.2 is 10. With a 7.2% return, your investment will double in value every 10 years. Review the table below to see how this hypothetical scenario could play out over the course of a lifetime.

| Year | Age | Total |

|---|---|---|

| 0 | 18 | $10,000 |

| 10 | 28 | $20,000 |

| 20 | 38 | $40,000 |

| 30 | 48 | $80,000 |

| 40 | 58 | $160,000 |

| 50 | 68 | $320,000 |

| 60 | 78 | $640,000 |

| 70 | 88 | $1,280,000 |

4. Budget Your Earning, Spending, and Saving

Ellen and I set an annual budget that we measure ourselves against on a monthly and year-to-date basis. Whether you budget monthly or annually, it’s a beneficial exercise that can save you significant amounts of money when sustained long-term.

We use many of Mint.com’s default budget categories and subcategories then add our own as needed. Here’s what our Auto, Food & Dining, and Home categories look like. These are generally our three largest expense categories so they also have the most sub-categories.

- Auto

- Gas & Fuel

- Auto Insurance

- Auto Licensing

- Auto Registration

- Citations

- Gas & Fuel

- Parking

- Service & Parts

- Tolls

- Food & Dining

- Alcohol & Bars

- Coffee Shops

- Fast Food

- Groceries

- Restaurants

- Snacks

- Home

- Additional Principle

- Furnishings

- HOA Dues

- Home Improvement

- Home Insurance

- Home Service

- Home Supplies

- Lawn & Garden

- Mortgage & Rent

- Moving Expenses

- Storage

I’d recommend using as many budget categories as you find useful. It’s not necessary to have as many sub-categories as we’ve listed above. Most months, we just reference our 20 main categories and our groceries sub-category. We only drill into the underlying sub-category detail when we’re investigating an unusual level of spending in one of our main categories. Even though we often don’t need the sub-category detail, there’s almost no extra work on our part to have it there when we want to reference it. Mint.com does a good job of automatically assigning our spending to our various categories and sub-categories.

5. Build and Maintain an Emergency Fund

Regardless of your other financial goals above, an important short-term milestone is establishing an emergency fund. As the name suggests, an emergency fund is simply money that you keep on hand in case you encounter some financial emergency. I’d suggest saving at least a couple of months of expenses to help you overcome any unplanned loss of income or unexpected expenses. It may be helpful to keep that money in a separate account to reduce the likelihood it gets used for day-to-day expenses or luxury spending.

Having said that though, your emergency fund is there to be used as needed so don’t get frustrated if you have to occasionally rely on that money. Remind yourself that you saved that money to handle situations like this and consider how much more difficult it would be without that reserve to rely on. Just patiently build your emergency fund back up so you’ll be prepared to peacefully navigate the next financial setback.

6. Continue Monitoring Your Spending Behavior for Potential Improvements

What gets measured, gets managed.

– Peter Drucker

Your financial plan shouldn’t be a set-it-and-forget-it plan. It’s important to consistently review your performance against your budget and progress toward your goals.

Mint.com and Personal Capital are all you really need to perform a good monthly review. We live this stuff so we also use a spreadsheet I created back in 2012. Our spreadsheet generates a summary report for us that we review together on the first Sunday of the month. It also lets us see a few metrics that we find important, but that are currently unavailable in either Mint.com or Personal Capital. For example, we can easily compare the prior month with our trailing 12 month averages. It calculates our savings rate and project our net worth for the next 30 years. And it compares our current net worth to our estimated net worth needed for retirement.

Whether you just use tools like Mint.com and Personal Capital or you also maintain your own spreadsheet, the practice of reviewing your numbers monthly can save you a lot of money over the years.

For discussion:

Are there any other practices you would recommend to people looking to improve their financial health?

This post contains affiliate links. For more information, see our disclosures here.